How to Trade Support and Resistance in Forex

Novice traders have to deal with many challenges. They need to learn the proper way to deal with supports and resistance created by the market. No matter what pattern they are searching for, or what analyses they are deploying, having an in-depth notion about the upper and lower limit of the market is something no one can or should avoid. In this article, we will discuss some of the important factors associated with support and resistance. Let’s dive into the detail.

Trading Forex Market’s Supports-And Resistances

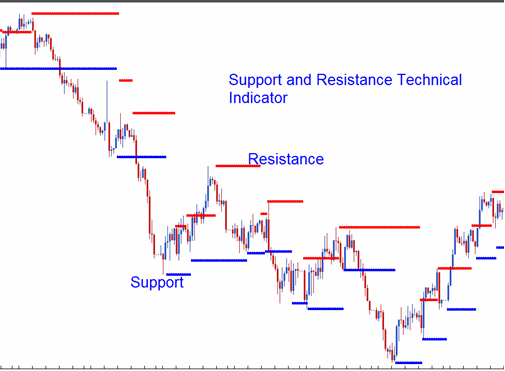

When the market decides to move up and then pulls back, the apex point reached by the move before its pulling back is called the resistance zone or the upper limit of the move.

After pulling back, when the market again makes a reverse turn, that is the lowest limit of that trend and the point is called support.

Highest and Lowest Limit’s Zone

One thing every investor should understand is that bolster and defiance levels are typically not the same numbers. To learn how to filter out pretentious breaks, you should think of bolster and defiance lines as more of a zone rather than solid numbers. Among many ways to recognize such zones is by drawing support and resistance on a line graph instead of in a candlestick graph. Support and resistance can be reversed. Investors should also understand that when a price crosses through a defiance level, that defiance could turn into a bolstered level.

The same thing can happen with a bolstered line. When it gets crossed by the price, it may turn into a defiance level.

The one turning into another is known as a “role reversal”.

Trend Lines

In their most basic form, a bullish line is depicted along the base of easily recognizable bolster areas. In a bearish trend, the line is depicted along the peak of easily recognizable resistance zones. Before you start to trade with the key trend lines, make sure you learn about the basics of the CFD trading industry. Visit https://www.home.saxo/en-sg/products/cfds and get a professional idea about the critical approach to trading.

Trend Channels

A trader can observe three kinds of trend channels.

- An ascending trend channel comprises of higher lows and higher highs.

- A descending trend channel comprises of lower lows and lower highs.

- A horizontal channel where the market seems to the range.

To draw an ascending or up channel, traders should simply depict a parallel line following the determined angle of an uptrend and then sweep it to a zone where it crosses the trend line.

To draw a descending or down channel, traders should depict a parallel stroke following the determined angle of a downtrend stroke and then sweep it into a zone where it crosses the recent valley.

To draw sideways or horizontal channels, they should simply depict a parallel line at a flat or zero degree angle.

The Bounce and Break

While trading the bounce, traders want to pull the odds in their favor and confirm that the bolster and defiance level will hold.

Rather than simply purchasing and selling blindly, traders should wait for the movement to bounce first before deciding to enter. By waiting for the moment, traders can avoid situations where the price fluctuates fast and sifts through support-and resistance level like a knife cutting through soft butter.

Traders can trade breaks in aggressive or conservative ways. Trading aggressively, a person simply purchases or sells whenever the price crosses through a support or resistance zone with comfort.

In a conservative method, traders wait for the rate to create a pullback to that broken support and resistance level and enter when the price bounces.

So, this is all about trading support-and resistances in a brief form. If you want to learn more about all the different aspect of trading these levels, you should check some of the other resources, or take an educational Forex course.