U.S. manufacturers have all they business they can handle, but major shortages are a big headache

The numbers: American businesses are still struggling to cope with broad shortages of key supplies and skilled labor even as customer demand for their goods climbs above pre-pandemic levels.

A survey of U.S.-based manufacturing activity slipped to 60.6% in June from 61.2% in May, according to the Institute for Supply Management. That was slightly below the Wall Street forecast.

Although any number above 60% is exceptional, companies still have lots of worries even as the orders roll in.

Prices for many materials have risen sharply, products aren’t getting delivered on time, and in some cases companies simply lack enough labor to make as much as they can sell, the survey indicated.

The increase in the ISM index was a touch below the forecast of economists surveyed by The Wall Street Journal. The index was expected to total 61%.

Any reading over 50% signals growth.

Read: The U.S. economy is running ‘very hot’, IHS Markit finds, and so is inflation

Big picture: Manufacturers have all the orders they can handle. The problem is filling them.

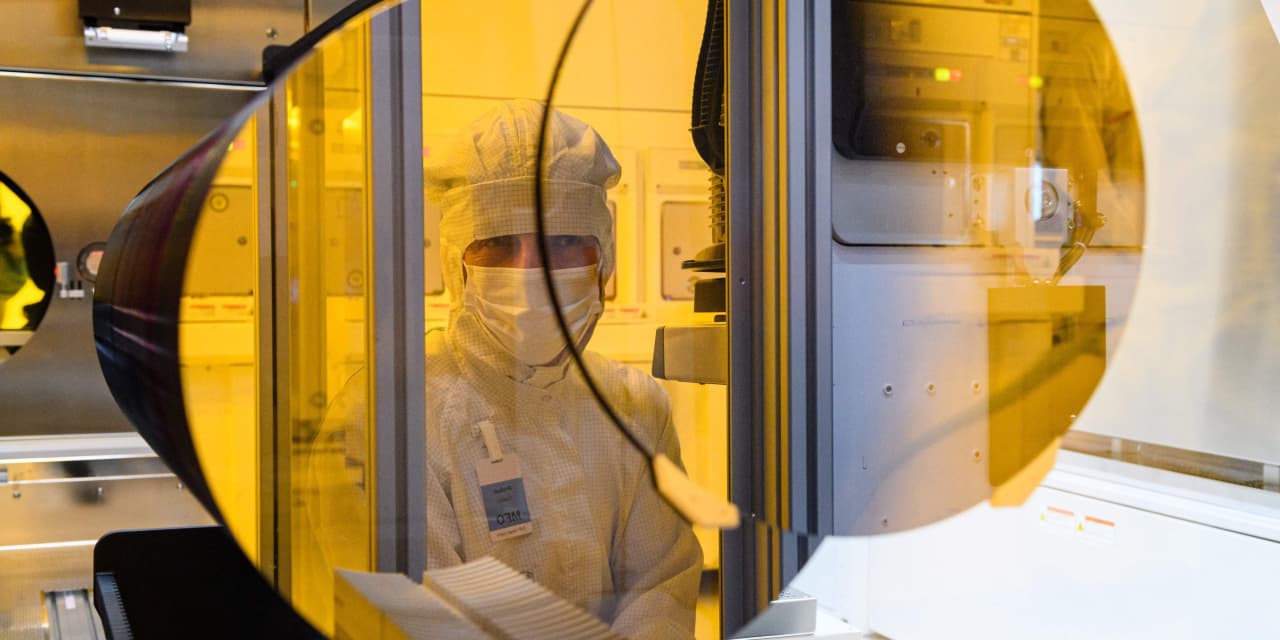

The pandemic upended global trading patterns and made it harder to procure vital supplies and materials such as computer chips. These bottlenecks aren’t going to go away right away.

Then there’s a lack of skilled labor, a problem that bedeviled manufacturers even before the pandemic. That’s a problem that might be even harder to solve.

Read: Now hiring: U.S. seen adding 700,000 jobs in June

One way to cope with a labor shortage is through the increased use of technology and automation. Business investment has soared over the past year to the highest level in decades. They big payoff probably won’t come for a few more years, however.

Key details: A measure of new orders slowed a bit in June but remained near a 17-year high. Orders reflect now much new business a company is receiving.

Production rose, but it’s barely keeping up with new orders. A gauge of production rose to 2.3 points to 60.8%.

The big stumbling blocks are a shortage of key supplies and skilled labor.

Many companies are paying higher prices for materials and in turn trying to pass those costs onto customers. In many cases, they can’t ship products to customers on time.

Keeping their plants fully staffed is part of the reason why. Many workers are still going absent on the job even though the pandemic has faded and turnover is high.

Read: U.S. unemployment claims sink to pandemic low of 364,000 as extra benefits start to get phased out

Timothy Fiore, chairman of the ISM survey, said some new employees are leaving for better-paying jobs or deciding the work is not for them.

“The need for labor continues to hold back production levels,” he said. “Companies are still having difficulty attracting new workers.”

The employment index fell below the 50% cutoff mark for the first time since last November even though companies want to hire.

“Lack of labor is killing us,” said a manufacturer of primary metals. “Manpower has been a concern,” added an executive at a chemical company.

What they are saying? “The manufacturing sector continues to benefit from strong growth in consumer spending and business investment, even as it grapples with ongoing challenges in supply chains, material shortages, and tight labor markets,” said Jim Baird, chief investment officer at Plante Moran Financial Advisors

Market reaction: The Dow Jones Industrial Average

DJIA,

and S&P 500

SPX,

both rose in Thursday trades.